How to invest in silver & silver stocks (2024)

Investing in silver is popular because, just like gold, silver is limited in availability and can therefore rise in value. In this article, we will discuss how and where to invest in silver. You can also find an overview of interesting silver stocks and we study which factors influence the price of silver.

Where can you invest in silver?

You can invest in silver online through brokers, for example by buying a silver ETF or silver stock:

| Brokers | Benefits | Register |

|---|---|---|

| Buy silver without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of silver! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of silver with a free demo! |

How to invest in silver?

Method 1: Track the price of silver with an ETF

If you want to invest in silver for the long term, you can choose to do so with an ETF. ETFs are securities designed to track the price of an underlying asset as closely as possible. Examples of ETFs that allow you to track the silver price are:

- Wisdom Tree Physical Silver: with this ETF, you can invest in silver in euros (0.49% ongoing costs).

- Sprott Physical Silver Trust USD: this ETF is larger than the Wisdom Tree ETF, but listed in dollars (0.76% ongoing costs).

- iShares Physical Silver: another fund that allows you to track the silver price in dollars (0.21% ongoing costs).

For long-term investments, silver ETFs are often the best choice. It is typically most cost-effective for individuals to invest in silver via an ETF since you don’t have to pay a premium on the price.

Method 2: speculate on the price of silver through derivatives

With derivatives, you can actively speculate on both rising and falling prices. This allows you to respond to different market conditions.

For active speculation, you can use CFDs or futures. Remember that these types of investment products are only suitable for short term investments, since you pay financing costs when using derivatives. In this article, you can read how daytrading on silver and other commodities works.

Method 3: invest in silver stocks

You can also choose to invest in silver stocks. By buying shares in silver mines, you indirectly invest in the price development of silver. However, it is important to mention that silver is typically a by-product of mining for other precious metals.

Some examples of silver stocks that you can invest in are:

- Pan American Silver

- Silvercorp Metals

- Adraitic Metals

- Mag Silver Corp

- First Majestic Silver

Remember that the price of a silver stock is not directly linked to the silver price. Other factors play a role in establishing the price of a silver stock.Therefore, study the fundamental data of the company before purchasing the stocks.

Method 4: Investing in Options

It is also possible to invest in silver by using options. With options, you purchase the possibility (but not the obligation) to buy or sell silver at a certain value. In this guide, you can read more about investing in (silver) options:

Method 5: Physically Investing in Silver

People who fear total devaluation of money often prefer physical investments in silver. You can invest in physical silver by buying bars or by purchasing coins.

Disadvantages of Physical Silver

With physical investments in silver, you need to be careful. It is essential to get insurance and to store the silver in a safe. With physical silver, you generally achieve a lower return than with ETFs.

There are also companies such as Goldrepublic where you can purchase and store silver. However, keep in mind that these companies charge a hefty premium.

Purchasing physical silver is therefore mainly popular among collectors and among more paranoid investors who fear the end of the system. Personally, I prefer ETFs when investing in silver for the long term.

How is the demand for silver determined?

The demand for silver can be divided into two parts. The first part is the demand for silver as a safe haven, and the second part is called the industrial demand.

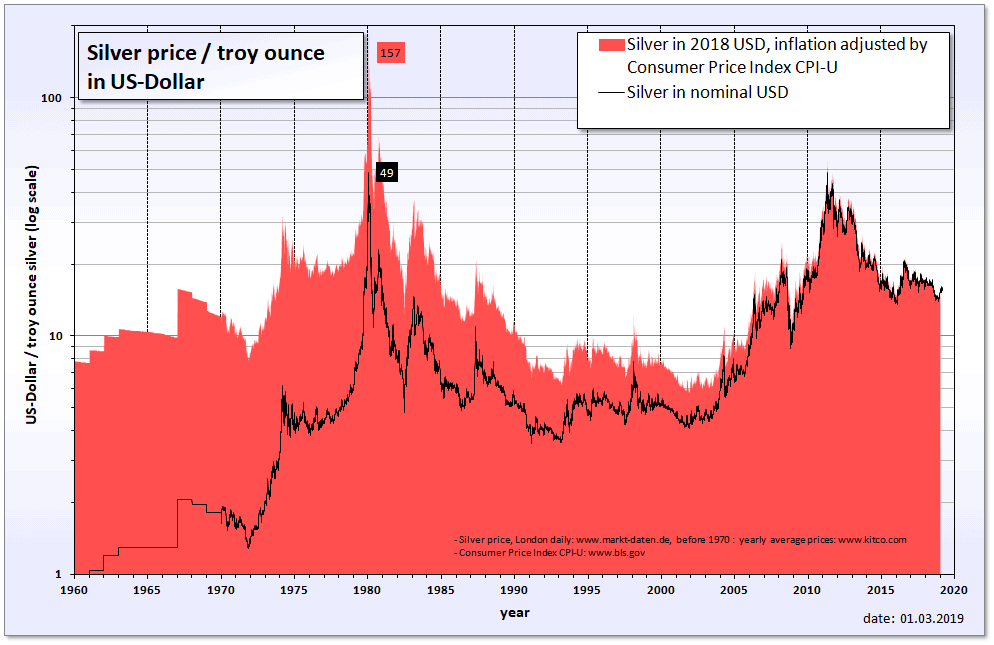

The development of the silver price over the years

1. Investing in silver as a safe haven

Sharp increases in the price of silver are often triggered by an economic crisis. During a recession, investors seek a safe haven. The shift of silver from an industrial metal to a monetary metal is therefore responsible for a large part of the current price increase.

Recently, there was another increase in the precious metals during a crisis. The coronavirus crisis immediately caused the prices of gold and silver to rise sharply. It can therefore be wise to buy gold and silver during economically uncertain times.

As an investor, you should see silver as a precious metal separate from gold. The silver market is about 19 times smaller than the gold market. But precisely this small market size combined with a rapidly growing industrial demand for physical silver can make buying silver attractive.

2. Industrial demand for silver

As much as 85 percent of silver is used for industrial purposes. Silver is used in various technological products like mobile phones. Unlike gold, silver has a practical application. With the rise of new economies, the demand for silver in electronic products will only increase.

According to The Silver Institute, approximately 900 million ounces of silver are used, compared to about 700 million ounces that are mined from silver mines. This means that the above-ground silver inventory is being depleted annually. The silver supply, in other words, is shrinking drastically.

In 1950 the silver supply was about 10 billion ounces, but this decreased to 3.5 billion ounces in 2010. This caused the price of silver to increase significantly. Most silver consumption took place in the West. When you consider that more and more Asians use phones, DVD players, and iPods, you understand why buying silver can be aan attractive investment!

What factors influence the price of silver?

- Demand and supply: the interplay between demand and supply determines the ultimate price of silver. When demand increases significantly, the silver price can only go up.

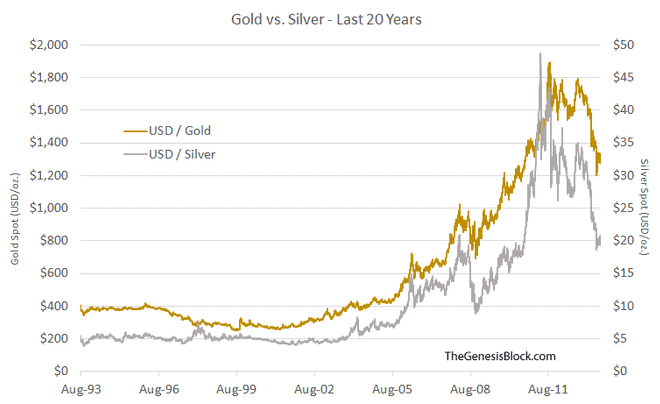

- Gold price: there is a strong correlation between the silver price and the gold price. When the gold price rises, the chance is high that the silver price will also rise.

- Value of the dollar: the price of silver is expressed in US dollars. When the dollar is weak, the silver price often rises since silver becomes cheaper for foreign investors.

10 reasons to invest in silver

1. Silver is affordable

Gold is too expensive for many investors. You have to pay between $2,000 to $2,500 for an ounce of gold. If you want to protect yourself during an economic crisis, you have to pay a significant amount at once. Silver is often 70 times cheaper, which means you can protect yourself against economic uncertain times with a much smaller amount of money.

2. Silver is tangible

Most investments are on paper these days; fiat, stocks, bonds, futures, and options are all intangible. When you physically buy silver, you can store it anywhere. People who value their privacy or have little trust in the financial system can consider buying silver.

3. Silver has value

You cannot go to the grocery store with a silver bar. However, most people still see silver as a form of money. Physical silver always has value. This is because it is not possible to print silver out of thin air, and physical silver cannot be stored digitally. The fact that silver is physical and limited in availability gives it value.

You also have the advantage that there is no counterparty risk. You do not need another party to fulfil a promise.

4. Silver is easier to sell

When we compare silver to gold, silver also gives you more flexibility. When you sell physical gold, you receive a large amount of money in one go. With silver, you can choose to sell a small amount of silver for a smaller amount of money. This allows you to use silver for smaller expenses.

5. More volatility

The market for silver is smaller than the market for gold. As a result, the silver price is more volatile. As a smart investor, you can take advantage of this by actively trading the price.

6. No stockpiles

Governments hold large gold reserves. This is no longer the case for silver, except in the United States, India, and Mexico, where governments still store silver. At the same time, we see that the industrial demand for silver is increasing. As a result, we will be less able to meet the demand for silver. Investing in a scarce commodity can pay off.

7. The global economy is growing

Another argument for investing in silver is the growing global economy. The worldwide demand for industrial goods is increasing, and silver is used in batteries and solar panels among others.

Silver is an essential metal for various electronics, since it is both electrically and thermally conductive and reflective. Economic growth seems unstoppable in the long term, which could mean that the demand for silver will only continue to rise.

8. Silver price has a limited ceiling

With many commodities, you see that too strong a price increase is curbed. Too high an oil price, for example, is detrimental to many companies. You then see that various organizations try to influence the price of oil. However, the negative effect of a high silver price is limited because there is only a limited amount of silver used in each product.

Central Banks can make the silver price decline. When the silver price has risen sharply, you often see that the banks sell part of their inventory, which puts some pressure on the price. However, when silver rises, there is a lot of room for upward movement.

9. Derivatives can further increase the price

It is also important to remember that most investments in silver take place on paper. With derivatives, investors constantly speculate on increases and decreases in the price. In most cases, however, they would rather not receive the silver and are satisfied with the profit or loss in dollars.

However, when the economy performs poorly, investors may choose to receive the silver after all. However, there are many more derivatives on silver in circulation than actual silver. As a result, the silver price can increase significantly when investors demand delivery.

10. Silver can protect you against inflation

Under the influence of inflation, your money becomes less valuable. This means that you can buy less with the same amount in your bank account.

However, commodities often rise in value with inflation. This means that an investment in, for example, silver can protect you against inflation.

What are the disadvantages of investing in silver?

1. Limited liquidity

A major disadvantage of investing in silver is the limited liquidity. You can typically sell stocks on the exchange within seconds. Selling physical silver takes more effort.

2. Limited return

The return on silver is also limited, since silver itself will not produce anything. When you buy a stock, you know that there is a company behind it which makes a profit. You can then receive a portion of the profit in the form of dividends.

Silver is only a form of possession that does not generate income. Investing in silver is only attractive under certain market conditions. When the price falls, you do not receive compensation in the form of dividends.

3. High transaction fees

Another disadvantage is the higher transaction costs. Especially when you buy physical silver, you often pay higher premiums. When you use a fund to invest in silver, you can avoid high transaction fees.

Protect your portfolio by hedging with silver

You can also choose to hedge with silver, a strategy that can be used to reduce the risk of your portfolio. If you invest in highly risky stocks, you can insure your portfolio by using this strategy. When the stocks plummet in value, silver can compensate for some of these losses. Click here to learn more about hedging.

Speculate on silver with leverage and short positions

Using leverage with silver

A leverage allows you to take a larger investment in silver with a smaller amount of money. With $100 you could trade in $500 of silver. A 10% rise in the silver price then leads to a profit of 50%. The opposite is also true; with a 10% decrease, you also lose 50% of your investment.

Short position on silver

You also have the option to take a short position. With a short position, you can speculate on a decline in the silver price. Here too, you must be careful: the price of silver can never fall below the zero mark, while the theoretical increase is unlimited. With a short position, you can therefore lose substantial amounts!

Practice trading silver

Do you want to try active speculation in silver? Then it is advisable to first open a free demo. With a demo, you can try out the possibilities without risk!

Some investment tips

Silver is generally more volatile than gold. Both precious metals have a strong correlation. When gold rises, silver usually rises and vice versa. However, silver reacts more strongly. When the price of gold falls, the price of silver often falls even more. It is therefore not uncommon for silver to fall or rise by more than five percent in a day.

There used to be a fixed ratio between silver and gold of about 1:15. It is now clear that this ratio does not always hold. The difference between the silver and gold prices has increased considerably and is now around 1:70.

There is a strong correlation between gold and silver

Frequently asked questions about investing in silver

Silver holds value better than fiat money. The money in your bank account actually becomes worth less every year, because central banks keep printing money. This is not possible with silver: this commodity becomes scarcer. In the long run, silver is therefore a store of value, but this does not mean that you will not incur losses in the short term.

In the long term, the silver price can only go up: the supply is decreasing while the demand for silver increases by approximately 6% each year. China and India are increasingly important players in the silver market, and silver is essential for the electronics and automotive sectors.

Analysts differ widely in their opinion of the expected silver price in the future. The silver price expectation of Jeff Clark for 2025 is at least $100. Whether this prediction will come true will depend heavily on the economic developments in the world. However, I expect the price of silver to continue to rise in the long term.

Some people claim that the silver supply is almost depleted: at current usage rates, there will be no silver left in about 30 years. However, this is likely to be an overstatement: only existing silver reserves are considered. When silver prices rise, it becomes profitable to mine silver in more difficult places.

The supply of silver on the market has actually increased significantly over the past 20 years. More silver has been extracted, and silver is also recycled more often. This may explain why the silver price has not exploded: many more investors are needed to buy all the new silver to drive the price up.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.