What are options? Everything you need to know about options

Are you curious about financial options? In this article, I will discuss in detail what options are and how they work!

What are options?

Options give you the option, but not the obligation, to buy or sell an underlying asset at a certain price. For example, with an option, you can buy ING shares at a fixed price of $10.

What types of options exist?

Type 1: What is a call option?

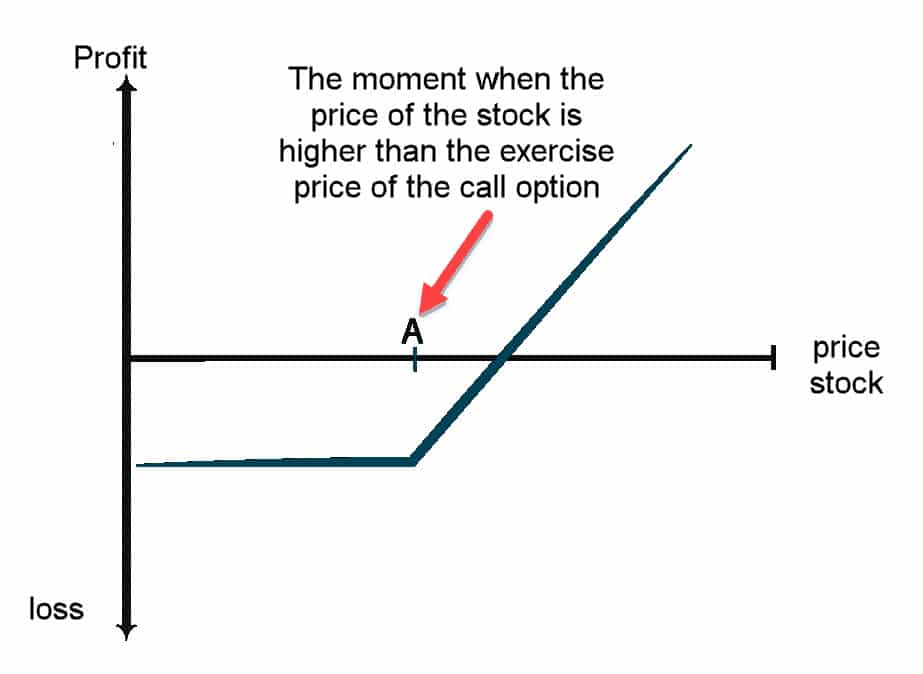

A call option gives the buyer the right to buy a stock at a fixed price. You would use this type of order when you think the underlying asset is going to increase in value.

Type 2: What is a put option?

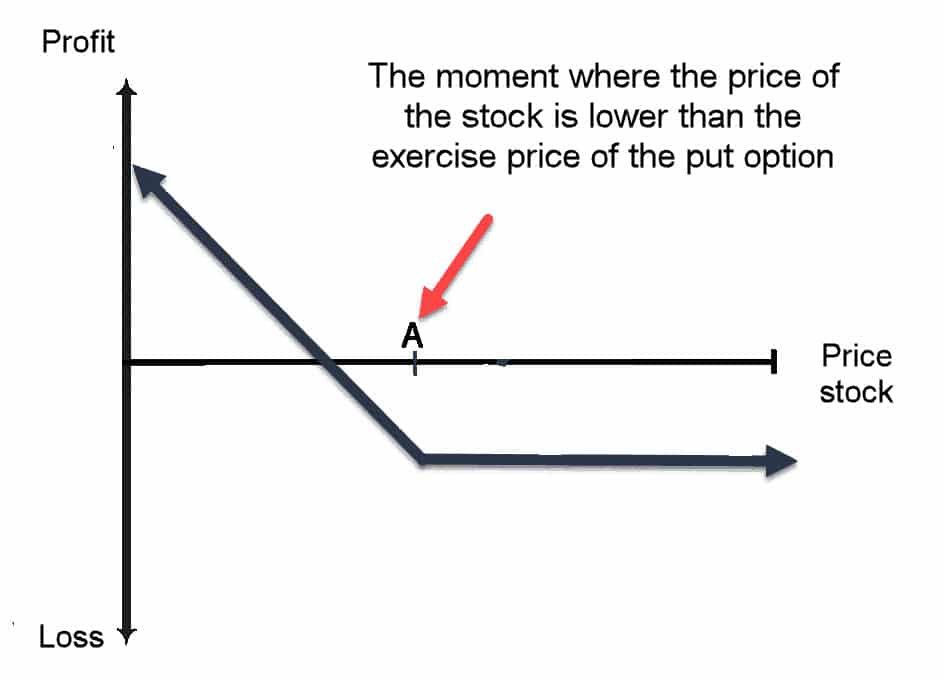

A put option gives the buyer the right to sell a stock at a fixed price. You would use this type of option when you think the underlying asset is going to decrease in value.

Who trades options?

Every option transaction involves two parties: the buyer and the writer. The buyer is the party who receives the option in exchange for a premium. The writer is the party who sells the option and thus assumes the obligation to deliver.

| Brokers | Benefits | Register |

|---|---|---|

| Buy without commissions. Your capital is at risk. Other fees may apply. | ||

| Speculate with CFD's on increasing & decreasing prices of ! 80% of retail CFD accounts lose money. | |

| Benefit from low fees, an innovative platform & high security! | |

| Speculate on price increases and decreases of with a free demo! |

What are the components of an option?

- Underlying asset: This indicates what underlying asset the option is related to. This could be a stock, index, currency pair, or commodity.

- Contract size: An option relates to 100 underlying securities. So, if the premium is $2, you would pay a total of $200.

- Exercise price: This is the price at which the underlying asset can be bought or sold.

- Price/premium: The premium or price you pay on the stock exchange for the option. When the conditions of the option are more favorable, you pay more.

- Expiration date: The date on which the option expires. This is the last moment you can exercise the option.

- Outcome: If an option is currently profitable, it is in the money, and if it is currently losing money, it is out of the money.

How can you invest in options?

You can invest in options through an online broker. Brokers make it possible to speculate in securities such as options. With most brokers, you must first take a knowledge test to prove that you understand how options work. Are you curious about which brokers allow you to invest in options? Then check out the overview of my favorite brokers:

What are the advantages of options?

- Higher return: by using options wisely, you can achieve a higher return. For example, if you already want to sell your shares, you can write call options to receive an extra premium.

- Leverage: options are leverage products. This means that you can take a bigger risk with a small amount of money. This increases both your potential profit and potential loss.

- Protection against price decline: you can use options to protect yourself against a price decline. With a put option, you receive a guaranteed price for your share, even if the share price drops.

- Speculate on a falling price: with put options, you can speculate on declining share prices. This offers you more flexibility than with ordinary shares.

Option examples: How do options work?

Call option example: you can buy a call option on Shell shares. You can then buy Shell at the price set within the option (point A). If the share price is higher at the time you exercise the option, you make a profit. You can then calculate your profit by subtracting the premium from the selling price.

Put option example: you can also buy a put option on Shell. You can then sell Shell at the price set within the option. If the price is lower at the time you exercise the option, you make a profit. You can then sell the share at a higher price than you pay for buying it.

How to read an option?

An option is quoted as follows:

ABC CALL 20 SEPTEMBER 2023 €100

- ABC: this is the underlying asset of the option

- CALL: the type of option, in this case, it is a call option.

- 20 SEPTEMBER 2023: the expiration date.

- €100: the exercise price of the option.

How does writing an option work?

You can also choose to write an option in exchange for a premium, but in this cae you incur an obligation:

- With a call option, you must sell the asset at the exercise price.

- With a put option, you must buy the asset at the exercise price.

You must be very careful when writing options: you can lose much more money than the amount you invest. This is especially the case when you write an uncovered option and do not yet own the underlying asset.

What are the risks of options?

- Loss of investment: you can lose your entire investment when investing in options.

- Call option writing risk: if the price of the underlying asset rises significantly, you will incur a significant loss.

- Put option writing risk: if the price of the underlying asset falls significantly, you will incur a significant loss.

- Difficult to price: it is very difficult for individual investors to understand the value development of an option.

What can you use options for?

- Speculation: you can use options to profit from short-term price fluctuations.

- Protection: with a put option, you can protect your investments against a price decline.

- Extra return: by writing call options, you can earn extra returns on stocks that you already wanted to sell.

- Leveraged results: the presence of leverage allows you to achieve greater results with a small investment.

How is the value of an option determined?

The price or value of an option consists of the intrinsic value and the time value.

What is the intrinsic value?

The intrinsic value is the amount that the option is worth at that moment. For example, if you have a call option to buy a share for $20 that is currently worth $25, the intrinsic value is $5 per share.

You can immediately buy the share for $20 and sell it for $25, which gives you a profit of $5 per share.

What is the time value?

If the intrinsic value determined the full price of an option, then the intrinsic value would always be equal to the price of the option. However, because of the time value or expectation value, this is not the case.

An option has a certain duration, and if investors expect that the intrinsic value of the option may increase in the future, then the price of the option will be higher:

- The expectation value is higher when the expiration date is far in the future.

- The expectation value is higher when the underlying asset has high volatility.

Option meaning: the Greek symbols

Greek symbols are used in options trading to indicate the risks of options.

- Delta (Δ): indicates how strongly the price of the option changes when the underlying asset changes. If the Delta is 0.8, the option would increase in value by $0.80 if the share rises by $1.

- Theta (Θ): indicates the time sensitivity of the option. If the Theta is -0.4, the price of the option decreases by $0.40 per day.

- Gamma (Γ): indicates how strongly the Delta changes when the underlying asset increases or decreases in value. If the Gamma is 0.1, Delta would increase by 0.1 if the share increases by $1.

- Vega (V): indicates how sensitive the option is to volatility. If the Vega is 0.2, the option would increase in value by $0.20 if the volatility increases by 1%.

- Rho (ρ): indicates the sensitivity of the option in relation to the interest rate. If the Rho is 0.1, the option would increase in value by $0.10 if the interest rate increases by 1%.

Conclusion: Who are options suitable for?

Investing in options is not suitable for everyone. Options are complex financial products that are only suitable for investors with a high risk tolerance. Now that you know what options are, you can determine if this investment product aligns with your investment profile.

Frequently Asked Questions about Options

There are two types of options: American and European options. American options are the most common and can be exercised at any time (up to the moment of expiration). European options can only be exercised on the expiration date.

There are two ways to make money by investing in options. The first method is by buying an option. When the underlying asset moves in the predicted direction, you make a profit.

It is also possible to write an option in exchange for a premium. When the option is not excercized, the premium is the full profit you make.

Most options expire on the third Friday of the month. This does not apply to daily options or weekly options. Therefore, be sure to pay attention to the expiration date when investing in options.

When you invest in options, you use leverage. You need to invest less money than when you buy the underlying asset directly. As a result, the potential profit with an option is higher than when you buy a stock directly. At the same time, your potential loss is also much higher: with an unexpected market movement, you can quickly lose your entire investment!

Options have different maturities. For liquid stocks, you can find options that cover 1, 2, 3, 6, and 12 months. You can also trade in short-term options that are sometimes valid for only one day. For investors with a long-term vision, you can also find options with a term of five years.

If you approach the situation wisely, you can earn high returns with options. An option can sometimes increase in value by more than ten percent. Of course, you can also experience significant losses: when the option becomes worthless, you lose the entire amount of your investment. With an option, you also do not receive dividends.

Yes, this is allowed. It can be a strategic move at different exercise prices.

When you buy a stock, you are the full owner of the asset. With an option, you buy the possibility to buy the underlying stock at a fixed price. However, with an option, you are not yet the owner of the stock.

Author

About

When I was 16, I secretly bought my first stock. Since that ‘proud moment’ I have been managing trading.info for over 10 years. It is my goal to educate people about financial freedom. After my studies business administration and psychology, I decided to put all my time in developing this website. Since I love to travel, I work from all over the world. Click here to read more about trading.info! Don’t hesitate to leave a comment under this article.